Navigating the world of online shopping can sometimes feel like a head-scratcher, especially when it comes to understanding delivery charges and their potential impact on your final checkout total. Initially, remember that shipping fees can vary widely depending on the store, the size of your purchase, and your location.

Furthermore, be aware that some regions may impose sales tax on online purchases, even if the seller is located in a other state or country. To avoid any unexpected costs at checkout, it's always a good idea to meticulously examine the shipping and tax policies of each seller before you complete your transaction.

- {To help you navigate this process, consider these tips:

Understanding Sales Tax on Shipped Goods: A Comprehensive Guide

Shipping products across state lines can often lead to confusion about sales tax laws. It's important to be aware of the nuances of sales tax when purchasing or selling goods remotely. This comprehensive guide will shed light on the essential factors to consider, assisting you to navigate the complexities of sales tax on shipped merchandise.

- , To begin with, we'll delve into the concept of nexus and its impact on sales tax obligations.

- Following this, we'll explore the various factors that determine sales tax rates on shipped goods.

- Lastly, we'll provide practical tips and information to help you comply with sales tax requirements.

Efficiently Calculate Shipping and Taxes for Your Business

Determining shipping and tax charges for your business is a crucial step in ensuring accurate pricing and smooth transactions. To calculate these costs, you'll need to factor in several elements. Start by identifying your product size, as this will affect shipping charges. Then, investigate different shipping carriers and compare their prices. Keep in mind that tax calculations vary depending on your jurisdiction and the type of goods you sell.

- Utilize online shipping calculators to estimate shipping costs based on your product details and destination.

- Research tax rules in your locality to ensure you are applying the correct amount.

- Think about offering diverse shipping alternatives to meet the requirements of your customers.

Transparency in pricing, including both shipping and taxes, can foster customer belief. Regularly audit your shipping and tax methods to ensure they remain advantageous

Zero-Cost Delivery: Planning Your Promotion

Offering tax-free shipping is a compelling strategy to attract sales and enhance customer satisfaction. Furthermore, implementing such promotions requires careful evaluation to ensure profitability and adherence with relevant tax laws. A comprehensive approach should involve analyzing shipping costs, determining potential savings, and establishing clear disclosure with customers about the promotion's conditions.

- Potential outcomes of tax-free shipping promotions include:

- Increased sales and conversion rates

- Improved customer loyalty and retention

- Competitive advantage in the marketplace

Bear in mind that tax-free shipping promotions could have challenges associated with them. It is crucial to seek advice with financial professionals to guarantee a successful and compliant implementation.

International Shipping: Navigating Customs Duties and Taxes

Embarking on international/global/overseas shipping often presents a critical juncture: understanding and navigating the labyrinthine world of customs duties and taxes. These financial/monetary/fiscal obligations are levied by destination/receiving/target countries on goods transported/shipped/moved across international borders. To ensure a smooth/seamless/trouble-free shipping experience, it's crucial to research/understand/familiarize yourself with the specific regulations/requirements/laws governing customs duties and taxes for your products/merchandise/goods.

Factors such as type read more of goods, value/worth/amount of the shipment, and the origin/source/country of manufacture can all influence the applicable/imposed/levied duties and taxes.

- Consulting/Seeking guidance from/Leveraging the expertise of a customs broker or freight forwarder can be invaluable in mitigating/minimizing/reducing potential costs/expenses/fees.

- Meticulous paperwork is paramount to streamlining/expediting/facilitating the customs clearance process.

- Staying informed/Keeping abreast of/Monitoring any changes in trade policies/customs regulations/import laws is essential for compliance/adherence/observance.

Impact of Shipping Fees on Product Pricing and Tax Liability

Shipping fees can significantly influence both the final price of a product for consumers and the tax obligation for businesses. When figuring out product prices, retailers often incorporate shipping expenses to ensure profitability. This can cause higher marked prices for customers compared to products with lower or free shipping alternatives. Moreover, the amount of shipping fees can impact a business's tax liability. In some jurisdictions, shipping fees may be considered part of the sale price and therefore subject to sales levies. Understanding the interplay between shipping costs, product pricing, and tax requirements is crucial for businesses to improve their profits and ensure compliance.

Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Shane West Then & Now!

Shane West Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Phoebe Cates Then & Now!

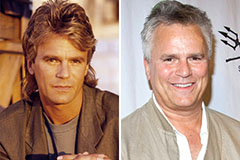

Phoebe Cates Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!